How to deal with the resolution of financial market infrastructures?

Financial market infrastructures (FMIs) are the backbone of the financial system: they enable market participants to transact with one another in an efficient manner. FMIs are inherently systemic, as their very names imply: payments systems, central securities depositories (CSDs), securities settlement systems (SSSs), central counterparties (CCPs) and trade repositories (TRs). If an FMI were to cease operation, it could put a stop to payments and/or securities and derivatives transactions. This in turn could destabilise financial markets and possibly the economy at large. To avoid such an outcome, steps need to be taken to ensure that FMIs’ critical economic functions continue, even if a particular FMI were to fail.

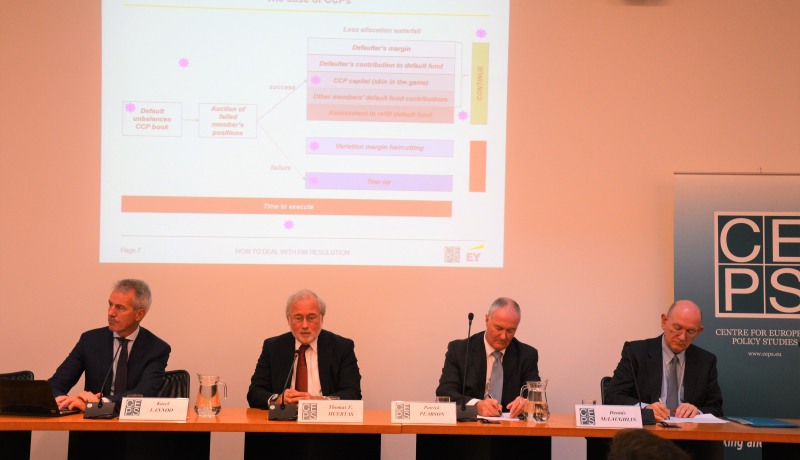

During the CEPS Lunchtime meeting, the 2nd Interim Report of the CEPS Task Force on the Resolution of Financial Market Infrastructures will be launched and discussed. The report, entitled “How to deal with the Resolution of Financial Market Infrastructures?”, highlights the issues that the resolution regime for FMIs should consider and options for how these could be addressed.

Speakers:

- Thomas F. Huertas, Partner, EY & Chairman of the CEPS Task Force

- Patrick Pearson, Head of Unit, DG FISMA, European Commission

- Dennis McLaughlin, Chief risk Officer, LCH Clearnet

Moderator: Karel Lannoo, CEO, CEPS

Please find more information on the event website.